Understanding Portugal Golden Visa fund safety is essential for global investors navigating the 2025 regulatory landscape. At Portugal Panorama, risk isn’t just monitored—it’s structurally mitigated through layered governance, licensed partnerships, and institutional-grade protections.

In the world of Golden Visa funds, compliance isn’t a bonus—it’s the baseline. What separates one investment from another isn’t access to the program, but how well the structure protects the capital behind it.

Portugal Panorama FCR was designed around a single idea: risk cannot be eliminated, but it can be managed—when governance is real, layered, and enforceable.

Governance Starts with Structure

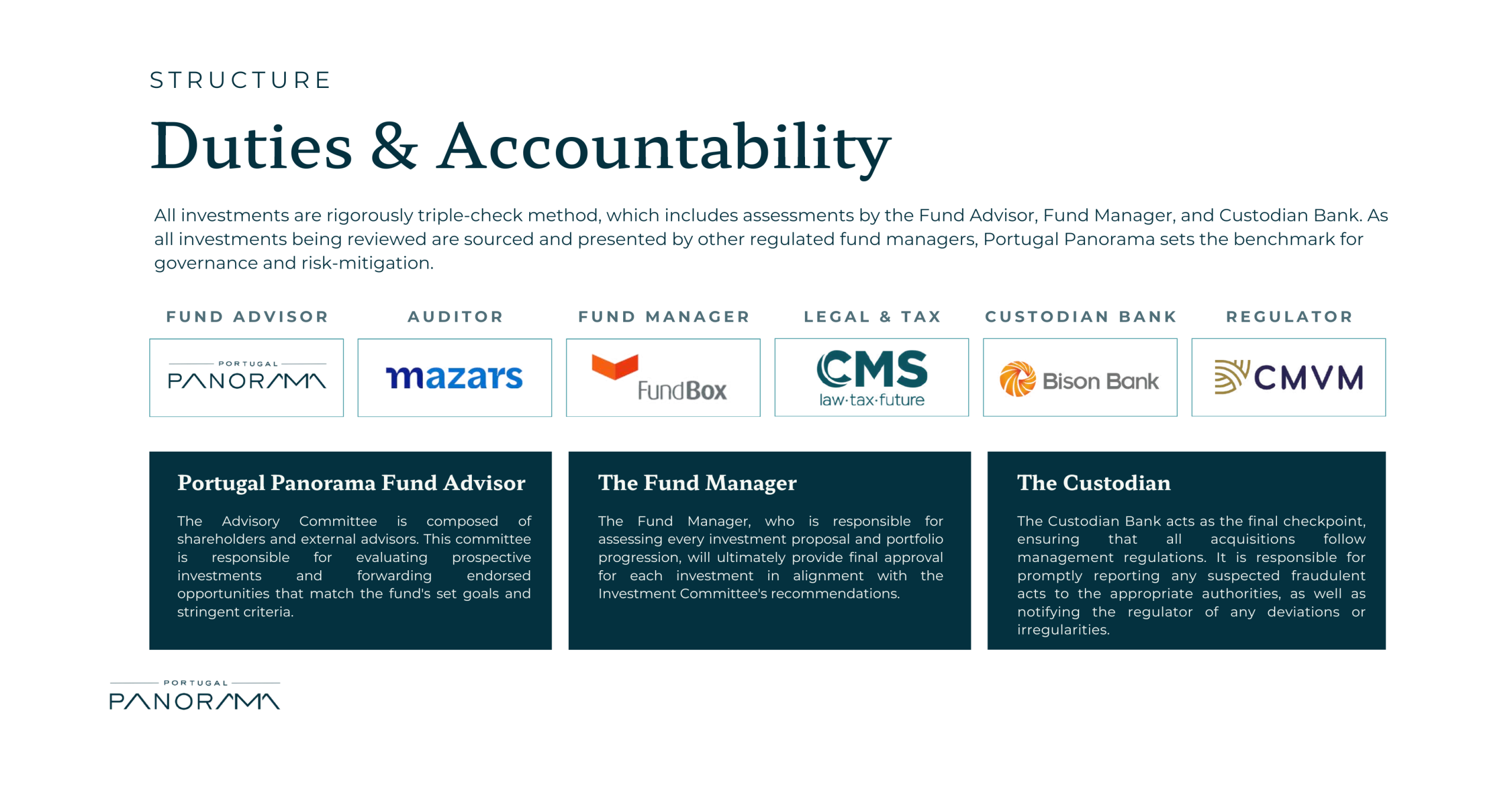

Portugal Golden Visa fund safety begins with regulatory design. The fund operates under the supervision of Portugal’s CMVM (Comissão do Mercado de Valores Mobiliários), the country’s capital markets authority. But beyond that foundational layer, Panorama is structured to ensure oversight at every stage.

FundBox SCR, the regulated manager, handles operational governance and investment reviews. Bison Bank, acting as the licensed custodian, safeguards client capital. And Mazars Portugal brings independent, internationally recognized audit assurance. Each plays a defined role—collectively forming a system of checks that extends beyond marketing claims.

Why Portugal Golden Visa Fund Safety Matters

The safety of a fund isn’t determined by promises. It’s measured by how thoroughly risk is distributed and who’s empowered to intervene. For Golden Visa applicants, the real questions are often unspoken: will this structure withstand scrutiny? Is my capital secure across multiple jurisdictions? And if something changes, who’s watching?

At Panorama, those answers are built into the operating model. Every investment is subjected to multi-party review, independent legal and custodial separation, and continuous audit oversight. This reduces execution risk and provides a framework for long-term investor protection—especially important in a cross-border regulatory context.

Diversification and Exposure Control

Another layer of security comes from structural limits. Panorama enforces a policy that caps allocation to any one Portuguese investment partner at 15% of fund capital. This safeguards investors against overconcentration, particularly in single-sector or founder-led deals.

When viewed against the backdrop of legacy real estate funds—where liquidity was often theoretical and valuations difficult to substantiate—Panorama’s model offers clarity, risk separation, and regulated visibility.

Final Thought: Safety Is a System

As the Golden Visa landscape continues to evolve, the demand for real fund safety has only increased. Today’s investors are looking for more than eligibility—they’re looking for structure.

At Portugal Panorama, safety isn’t a layer we add. It’s the framework we operate within.